Financial Aid Verification

Each year, the federal government selects around 30% of financial aid applications for verification to ensure eligible students receive all the financial aid they are entitled to for the academic year. If selected, don’t worry—you’ve done nothing wrong. You will simply need to submit the requested documents to Maricopa Community Colleges for verification before we can release your funds to you.

How to Know if You've Been Selected for Verification

Your FAFSA Submission Summary will indicate whether or not your FAFSA application has been selected for verification. Your FAFSA Submission Summary can be accessed via a link sent to your Maricopa Community Colleges email address by the Department of Education.

Look for an asterisk (*) next to your Expected Family Contribution (EFC) figure and read the message within the document.

You can also access this information in your Online Student Center. The Financial Aid Office will post information in your “To Do List” to let you know you have been selected for verification.

Need Assistance Completing Verification?

Live chat or schedule appointment with our financial aid staff to:

- Walk you through completing the forms related to the verification process

- Fully understand requirements related to verification

- Answer any questions you have regarding verification

Live Chat is available Mondays from 9–11 a.m. and Wednesdays from 3–5 p.m.

Frequently Asked Questions

To enter your parent's signature to the eForm, complete the following steps:

- Enter parent name and parent email address while completing the Verification Worksheet.

- Parent will then get an email from Dynamic Forms with a link to create an account.

- Parent will click on the link in the email. Please have parent check the junk/spam folder if the email does not appear in the inbox.

- If it is the first time logging into Dynamic Forms, parent will click Create New Account. This will give the parent the opportunity to create an account with Dynamic Forms. Note: If parent is also a Maricopa student, the parent will need to use a personal email account, not a Maricopa email account.

- After parent creates an account with Dynamic Forms, the parent will get another email to activate the account. Make sure the parent checks the junk/spam folder if the email is not in the parent's inbox. Once this email is received, the parent will click on the link and it will activate their account.

- Parent will then log in and will have the option to sign the Pending Form that the student has created. Once the parent is logged in, they will click on the Pending/Drafts Forms folder and then click Complete Form.

- Students who need assistance may send an email (from the student’s Maricopa official student email) to verification@domail.maricopa.edu. In order for us to better assist you, please include screenshots of the problems that you are encountering in your email to us.

- After selecting an option, you will be given the opportunity to upload your document. Click on Choose File to select the required documentation.

- Documents must only be uploaded using .pdf, .jpeg, or Word. We are not able to read HTML or password protected documents.

- This section will only allow you to upload one document. More documents may be uploaded in the Additional Documentation section.

- Click Choose File.

- If you have uploaded a document previously, you do not need to upload it again.

- Locate the appropriate file on your device and click Open. Your document will upload automatically after clicking open.

- Once the document uploads, you will see the title of the document and a box that says Delete File to the right.

- If you need to delete the file to upload a different document, please click Delete File and then do the previous steps with the correct document.

- If you are submitting a statement, please make sure it is physically signed.

Once you have filled out the Verification Worksheet, an email will be sent to the parent with information and a link to sign the worksheet.

Once the parent clicks the link they will need to create an account if one has not already been created.

*Note: If your parent has a Maricopa email address they will not be able to use it to make an account, so they will need to use another personal email account that they have access to.

After filling out the information to create an account they will receive a confirmation email containing a link to activate their account.

Once the parent has signed the Verification Worksheet, the student will receive an email confirmation.

If you want to check to see if a parent signature is still needed, log in to eForms.

- Use your Maricopa MEID and password to log in.

- Any forms in pending status that require parent signature will show a P next to the form.

- Click on Manage Co-Signers to send a reminder email to parent.

- Click Re-send Email.

Most students and parents are eligible to use the IRS Data Retrieval Tool on the FAFSA to transfer the tax information directly from the IRS website. However, if one of the following situations applies to the student/parent, the IRS Data Retrieval Tool may not be used:

- Are either you or your parent married, but either you or your parent did not file married filing jointly?

- If Yes, then you are not eligible to use the IRS DRT Tool

- If No, then you may be eligible to use the IRS DRT Tool

- Is parents’ marital status unmarried and both parents living together?

- If Yes, then you are not eligible to use the IRS DRT Tool

- If No, then you may be eligible to use the IRS DRT Tool

- Did parent use an Individual Tax Identification Number (ITIN) to file the tax return?

- If Yes, then you are not eligible to use the IRS DRT Tool

- If No, then you may be eligible to use the IRS DRT Tool

- Did student/parent file a Puerto Rican or foreign tax return?

- If Yes, then you are not eligible to use the IRS DRT Tool

- If No, then you may be eligible to use the IRS DRT Tool

- Did you recently file your tax return electronically within 3 weeks or by mail the last 11 weeks?

- If Yes, then you are not eligible to use the IRS DRT Tool

- If No, then you may be eligible to use the IRS DRT Tool

- Go to the IRS website and request online for a Tax Transcript to be sent to you.

- In the Request by Mail section, select the big blue button titled Get Transcript by Mail.

- Enter in your personal information. Note: Enter your information exactly as it was shown on your tax return.

- Select the option for a Return Transcript and the appropriate tax year.

- If your request was successful, you will receive a confirmation page.

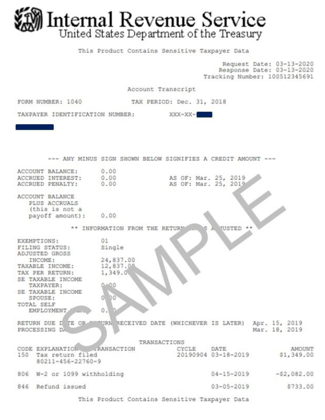

Sample Account Transcript

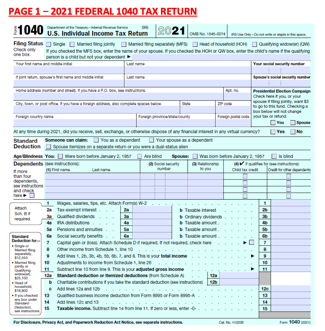

Federal Income Tax Return (1040)

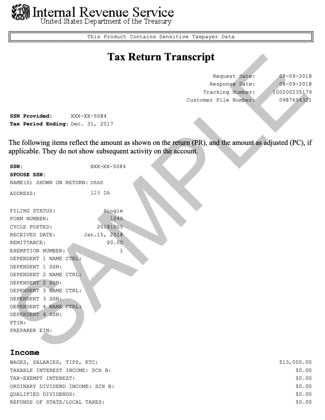

IRS Tax Return Transcript

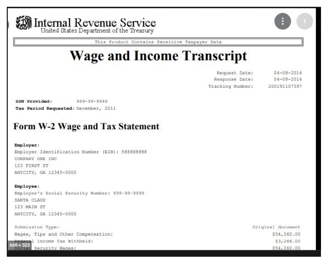

IRS Wage and Income Transcript

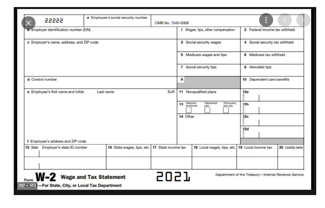

2021 W2 Form

The IRS Letter of Non-Filing can be obtained by using the IRS Form 4506T.

Follow the instructions below to obtain a Letter of Non-Filing for yourself:

- Indicate on #5b, Customer File Number, your Maricopa Student ID number (example: 3XXXXXXX).

- Select option #7, Verification of Non-Filing.

- Indicate on #9, Year or Period Requested, December 31st for the requested tax year.

- Mail or fax to the IRS at:

Internal Revenue Service

RAIVS Team

PO Box 9941

Mail Stop 6734

Ogden, UT 84409

Fax: 855-298-1145

If you are asked to submit W-2's but do not have any, please do one of the following:

- If you are not issued a W-2 based on your type of employment (example: Self-employed), please provide a detailed statement explaining the type of employment and amount you earned for the tax year.

- If you never received a W-2 from your employer or if you did receive a W-2 and have lost or misplaced it, please do not provide a statement. In these instances, students may obtain an IRS Wage and Income Transcript and upload instead of the W-2. The IRS Wage Transcript may be obtained at www.irs.gov.

The above options may be submitted electronically with your Income Worksheet, which is located in your Student Center To Do List. If you would prefer to fax your documentation, please include your Name and Student ID# on your submission and fax to: 480-361-5287.

If you have additional questions please send an email (from the student’s Maricopa official student email) to verification@domail.maricopa.edu.

If your Student Center To Do List item is displayed as Returned, follow these steps:

- Log in to your Student Center using your MEID and password.

- View your To Do List by clicking on the Tasks tile.

- View the status of each item on your To Do List.

- If any item has a status of Returned, log in to your Maricopa Student email.

- Look for any emails from verification@domail.maricopa.edu. These emails will give further instructions as to how you can complete the verification process.

- Your To Do List items will be removed once the verification process is completed.

If you would prefer to have your official student email delivered to a personal email address, follow these instructions to forward your email.

You are considered a veteran if:

- You were in Active Service, full-time service, as a member of the Regular Army, Navy, Air Force, Marine Corps and Coast Guard, and were released under a condition other than “dishonorable.” There is no minimum amount of time the student has to have served to be a veteran—even one day counts—but it does have to be active service.

- Members of the National Guard or Reserves are only considered veterans if they were called up to active federal duty by presidential order (Title 10) for a purpose other than training. The student must have had a character of service that was not “dishonorable.” If you did not receive a DD214 but can obtain a letter from a superior officer that documents the call-up to active duty by presidential order, and that classifies the character of service as anything but “dishonorable,” the student will be considered a veteran for Financial Aid purposes. You received a DD 214 that shows active duty other than training or Boot Camp.

- If you are currently on active duty, you aren't considered a veteran yet, but if your active duty will end by June 30, 2022 for the 2022-2023 FAFSA and June 30, 2023 for the 2023-2024 FAFSA, and so on, you count as a veteran for dependency status.

- If you attended a U.S. military service academy or preparatory school for at least one day and were released under conditions other than “dishonorable,” you will count as a veteran for Title IV purposes. Students serving in ROTC or currently attending a U.S. military academy are not veterans.

You are not considered a veteran if:

- You were a members of the National Guard or Reserves if your only training was basic training.

- You were never activated for federal active duty military service (Presidential Order; Title 10 only). Most members of the Reserves are not Veterans even if they have a DD214.

- You are serving in ROTC or currently attending a U.S. military academy.

You can provide the DD214 form showing that Character of Service is other than “dishonorable.” The Character of Service can only be found on Members-4 form and Service-2 form. However, until the information is corrected in the VA database, the match results will not change. If the documentation confirms that the student is a veteran, Title IV aid can then be disbursed to the student.

If the match results are correct and the you are not a qualifying veteran, then you must submit a correction to change the answer to Item 56 from “Yes” to “No” and provide parental information, including the signature of at least one parent.

What documentation is required to show that I qualify as a Veteran on the FAFSA (PDF)